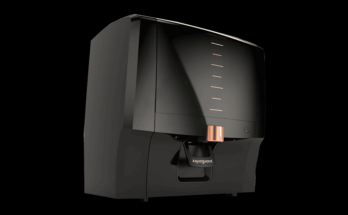

Decoding Water Purifier Machine Price vs. Features: RO, UV, UF, or Alkaline?

957 ViewsChoosing a water purifier is no longer just about picking the cheapest option on the shelf. With so many technologies available, RO, UV, and UF, understanding how each works …

Decoding Water Purifier Machine Price vs. Features: RO, UV, UF, or Alkaline? Read More